Welcome to the exciting world of Forex trading! With its potential for high profits and global reach, it’s no wonder that many individuals are drawn to this fast-paced market. However, before diving headfirst into the world of currency exchange, it’s crucial to understand the importance of effective risk management.

In Forex trading, risk is an inherent part of the game. But don’t let that scare you away! By implementing a solid risk management strategy, you can navigate the ups and downs of the market with confidence and protect your hard-earned capital. In this blog post, we will explore some effective Forex risk management strategies that can help you minimize losses and maximize your chances of success.

So grab your notepad and get ready to learn how to safeguard your investments in one of the most dynamic financial markets currently existing. Let’s dive deep into understanding why risk management is essential for every aspiring Forex trader!

Understanding the importance of risk management in Forex trading

Understanding the importance of risk management in forex trading is crucial for any trader looking to achieve long-term success. The forex market is highly volatile and unpredictable, making it essential to have a solid risk management strategy in place.

One of the main reasons why risk management is vital in forex trading is because it helps protect your capital from significant losses. By implementing proper risk management techniques, you can limit your exposure to potential risks and preserve your investment.

Additionally, effective risk management allows traders to stay disciplined and avoid impulsive decisions based on emotions. Emotions can often cloud judgment and lead to irrational trades that result in substantial losses. With a well-defined risk management plan, traders can maintain a level-headed approach even during periods of high volatility.

Furthermore, risk management helps traders set realistic expectations and goals. It enables them to determine an appropriate position size based on their account balance and overall risk tolerance. This ensures that they are not overly exposed to potential losses or taking unnecessary risks.

Understanding the importance of risk management in forex trading is paramount to achieving consistent profitability. By implementing effective strategies such as setting stop-loss orders, diversifying portfolios, and managing emotions while trading, traders can mitigate risks and increase their chances of success in this dynamic market.

Common risks in Forex trading and how to mitigate them

When it comes to Forex trading, there are certain risks that every trader should be aware of. One common risk is market volatility. The currency markets can be highly unpredictable and experience sudden fluctuations in value. To mitigate this risk, traders can use technical analysis tools and indicators to identify potential trends and make informed decisions.

Another risk in forex trading is leverage. While leverage can amplify profits, it also increases the potential for losses. Traders need to manage their leverage ratio carefully and only trade with funds they can afford to lose. Setting stop-loss orders is a useful strategy to limit losses and protect capital.

Risk associated with economic events is another consideration in forex trading. Economic data releases or geopolitical events can significantly impact currency values. Traders should stay updated on relevant news and have a plan in place for how they will react to such events.

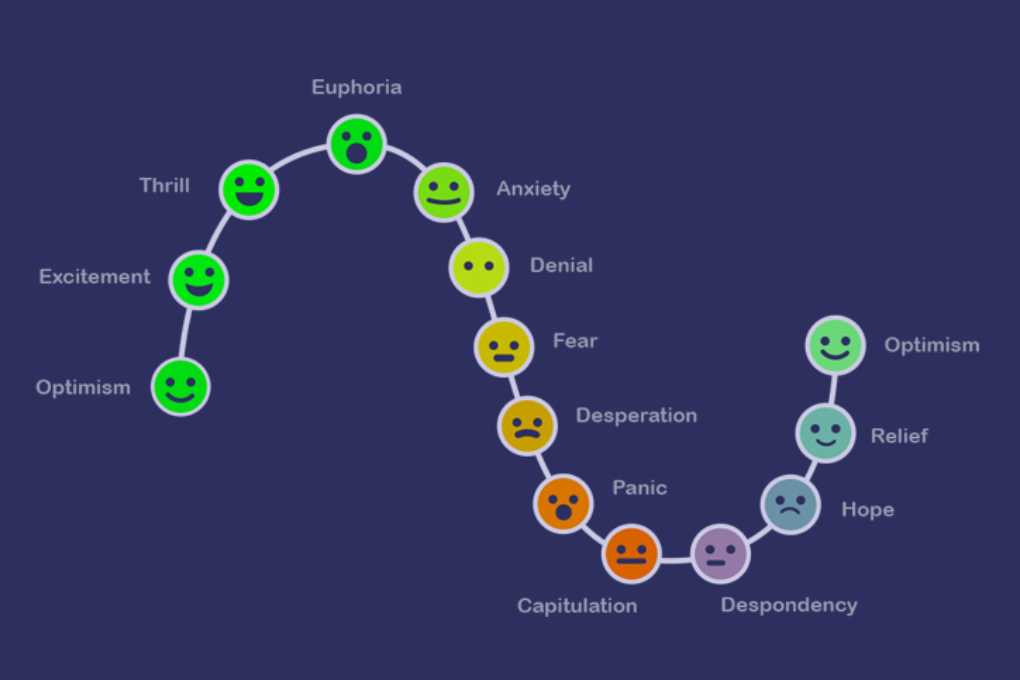

One more risk in forex trading is emotional decision-making. Greedy or fear-driven trades often lead to poor outcomes. To mitigate this risk, traders should develop a disciplined approach based on sound analysis rather than making impulsive decisions based on emotions.

Counterparty risk is an important consideration when choosing a broker or platform for forex trading. Traders should conduct thorough research and choose reputable brokers who offer secure platforms for executing trades.

By understanding these common risks and implementing effective strategies like technical analysis, stop-loss orders, disciplined decision-making, and careful selection of brokers, traders can minimize the impact of these risks on their Forex trading activities

Setting risk tolerance and managing emotions while trading

One of the keys to successful forex trading is setting a risk tolerance level that aligns with your personal financial goals and comfort level. This involves determining how much capital you are willing to risk on each trade, as well as establishing a maximum drawdown limit. By defining these parameters upfront, you can avoid making impulsive decisions based on momentary market fluctuations.

Managing emotions is another crucial aspect of effective forex risk management. The volatile nature of the currency markets can trigger strong emotional responses, such as fear or greed, which can lead to poor decision-making. It’s important to stay disciplined and stick to your predetermined risk management plan even when faced with adversity or tempting opportunities.

To manage emotions effectively, it may be helpful to implement strategies such as taking regular breaks from trading, practicing mindfulness techniques, or keeping a trading journal to reflect on past trades and identify patterns in your emotional reactions.

Additionally, surrounding yourself with a supportive network of fellow traders who understand the challenges involved in forex trading can provide valuable encouragement and advice during times of stress.

In conclusion,

Setting an appropriate risk tolerance level and learning how to manage emotions are integral components of successful forex risk management. By staying true to your established guidelines and remaining emotionally disciplined throughout your trading journey, you increase the likelihood of achieving consistent profits eventually. Remember that forex trading is not solely about making money, but also about preserving capital and protecting yourself from unnecessary risks.

Diversification and hedging as risk management strategies

Diversification and hedging are two essential risk management strategies in the world of forex trading. By diversifying your portfolio, you spread your investments across different currency pairs, reducing the impact of any single trade on your overall performance. This helps to mitigate the risk associated with a particular currency or market.

One way to achieve diversification is by trading multiple currency pairs that have low correlations. For example, if you have a long position on EUR/USD, consider opening a short position on USD/JPY. This way, if one trade goes against you, there is a higher chance that the other trade will move in your favor.

Hedging involves taking offsetting positions to protect yourself from potential losses. For instance, if you have a long position on GBP/USD but anticipate some downside risk due to an upcoming economic announcement, you can open a short position on GBP futures or options as insurance against potential losses.

It’s important to note that while these strategies can help manage risk, they also come with their own set of considerations and costs. It’s crucial to carefully analyze and assess whether implementing these strategies aligns with your trading goals and preferences.

Diversification and hedging are valuable tools for managing risks in forex trading. By spreading out investments across different currencies and protecting against potential losses through offsetting positions, traders can better navigate unpredictable market conditions and protect their capital investment

The role of stop-loss orders in risk management

The role of stop-loss orders in risk management cannot be overstated when it comes to forex trading. These orders act as a safety net, helping traders limit potential losses and protect their capital.

By setting a stop-loss order, traders establish a predetermined price at which their position will automatically be closed if the market moves against them. This ensures that losses are kept within acceptable limits and prevents emotionally driven decisions during turbulent market conditions.

Stop-loss orders provide traders with peace of mind, knowing that even if they are not actively monitoring the markets, their positions will be automatically closed if the price reaches a certain level. This allows for more disciplined trading and reduces the possibility of impulsive actions based on fear or greed.

Another benefit of using stop-loss orders is that they allow traders to manage multiple positions simultaneously. By setting different stop levels for each trade, they can ensure that overall risk is spread out across various currency pairs and minimize exposure to any single trade.

However, traders need to set realistic and appropriate stop levels. Placing stops too close to the current price may result in premature exits due to regular market fluctuations, while placing stops too far away could lead to larger than desired losses.

Incorporating stop-loss orders into your Forex risk management strategy is crucial for preserving capital and maintaining discipline in trading. Utilizing this tool effectively can mitigate potential losses and increase your chances of long-term success in the forex market.

Developing a Personalized Risk Management Plan

As we conclude our discussion on effective Forex risk management strategies, it is crucial to emphasize the importance of developing a personalized plan that suits your trading style and risk tolerance. While there are general guidelines and principles to follow, it is essential to tailor your approach based on your circumstances.

To develop a personalized risk management plan, consider the following steps:

- Assess Your Goals and Risk Tolerance: Begin by evaluating what you aim to achieve through Forex trading and how much risk you are willing to take. This self-assessment will help you determine realistic profit targets and set appropriate stop-loss levels.

- Define Position Sizing: Determine the maximum amount of capital you are willing to allocate for each trade based on your risk tolerance. Avoid risking more than 1-2% of your account balance per trade, as this can help protect against significant losses.

- Set Stop-Loss Orders: Utilize stop-loss orders effectively by placing them at strategic levels that align with your analysis and risk appetite. This tool acts as an automatic trigger to exit trades if they move against your expectations, limiting potential losses.

- Use Take-Profit Levels: Similarly, incorporate take-profit orders into your trading strategy to secure profits when prices reach predetermined levels. You can prevent letting market fluctuations or your emotions get the better of you by setting clear profit targets.

- Regularly Monitor Performance: Keep track of each trade’s outcome and evaluate their success rate over time. Analyzing performance allows you to identify any patterns or weaknesses in your strategy that need adjustment.

- Adapt as Necessary: Markets evolve continuously, so be prepared to adapt your risk management plan accordingly. Stay updated with economic news, market trends, and other factors influencing currency movements to make informed decisions about adjusting position sizes or altering stop-loss levels.

Remember that no single approach guarantees success in Forex trading; it takes time, experience, and constant refinement to develop a risk management plan that works for you. By applying the strategies.

If you’re a teenager looking to explore online opportunities, check out “5 Ways to Make Money As a Teenager Online” for valuable insights into earning through digital channels. Stay informed and financially savvy on your journey to success!